direct vs indirect cash flow which is better

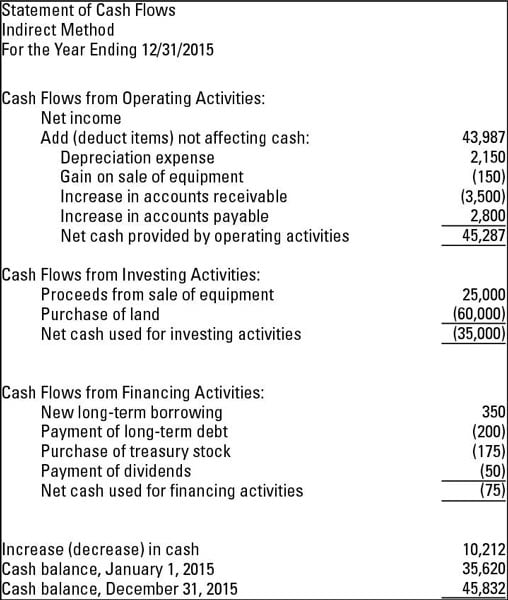

With the indirect cash flow method you begin with your net income and then add back or deduct those items that do not impact cash. Information for indirect cash flow is simple to compile as it comes directly from the income statement and balance sheet.

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

However the direct.

. Primary distinction between the direct and indirect cash flow statements is that operating activities generally report cash payments and cash receipts occurring throughout the. As you can imagine the risk of mistakes on a direct cash flow statement is more significant than on a cash flow statement prepared using the indirect cash flow method. For a company with many.

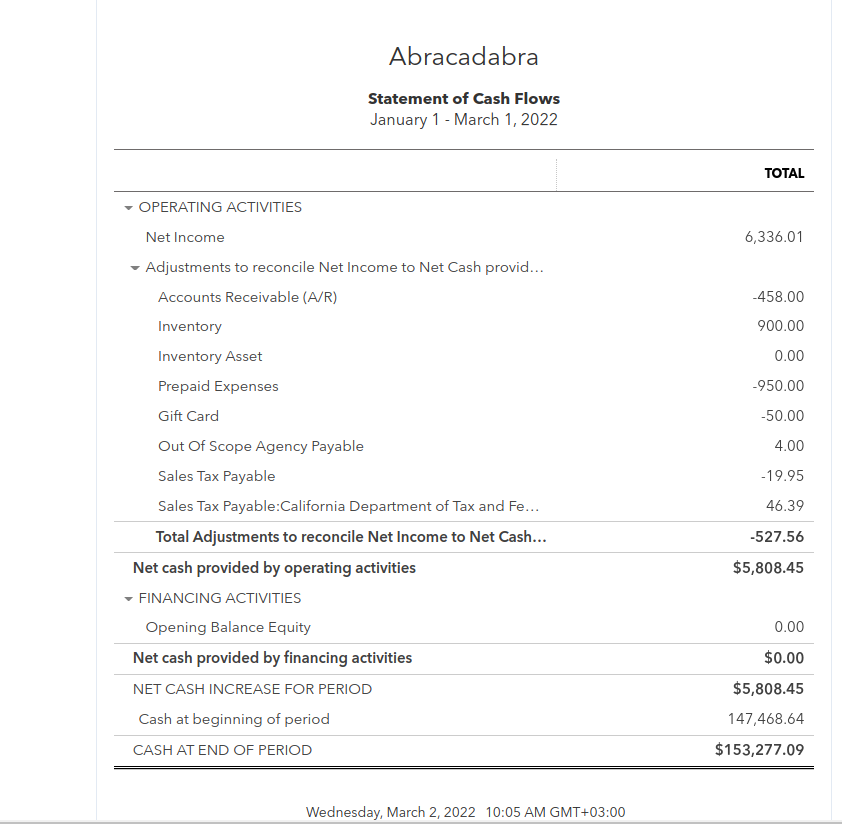

Forecast your future cash position and regain your control on your business finances. A business cash flow statement shows the companys profits and losses within a given time frame. Direct vs Indirect cash flow forecasting - the key differences How is direct cash flow forecasting prepared.

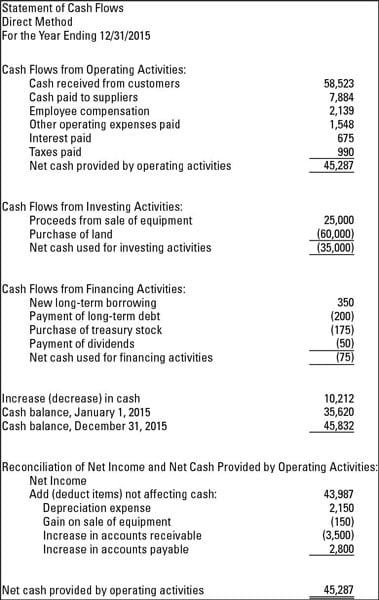

Comparing the Direct and Indirect Cash Flow Methods The direct method and the indirect method are alternative ways to present information in an organizations statement of. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. Direct cash flow forecasting relies on the companys cash collections and.

Apply Now Get Low Rates. The indirect method is relatively complex method as compared to the direct method as it utilizes net income as the base and performs necessary cashflow adjustments. Yet for a long-term overview the indirect method may be more beneficial.

The key differences between the Direct vs Indirect Cash Flow Methods are as follows. If a company is already keeping accrual accounting records the indirect method would be easy to prepare and not require additional tracking. They both offer part of the picture.

To compare the direct vs. The direct method is more suited for third party use and short-term planning and analaysis. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions.

The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting year by source whereas indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities. Why direct cashflow is better for your business Traditionally many businesses have preferred using the indirect cashflow method because it uses numbers that are freely available. Ad Compare Top 7 Working Capital Lenders of 2022.

Its faster and better aligned with the way this accounting. The direct method is particularly useful for smaller business that dont have. Ordinarily this information is readily available through your accounting system.

One of the adjustments can be regarded as the treatment of non-cash expenses. Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times. In addition direct cash flow forecasting is better for third-party use while the indirect.

Unlike the direct method the indirect method includes your net profit letting you better compare cash flow with net profit to explain how your business receives cash. Additionally while direct cash flow forecasting techniques are relatively simple. Ad Get Instant Access to All Templates You Need to Start Run Grow Your Business.

Its not a question of one being better than the other. The indirect cash flow method makes reporting cash movements in and out of the business easier for accruals basis accounting. Though the Financial Accounting Standards Board generally prefers the direct method statement of cash flow both the direct and indirect methods of cash flow are in line.

Indirect cash flow a business needs to know its overall net cash flow.

Answered B Sc Finance Management Et Bartleby

Statement Of Cash Flows Indirect Method Format Example Preparation

Direct Vs Indirect Cash Flow Method What S The Difference

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Methods For Preparing The Statement Of Cash Flows Dummies

Cash Flow Statements Explained Blog

The Indirect Cash Flow Method How To Use It And Why It Matters Bplans

Statement Of Cash Flows Direct Method Vs Indirect Method Accounting Instruction Help How To Financial Managerial

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Direct Vs Indirect Cash Flow Forecasting Highradius

What Does The Cash Flow Statement Report Tell Us Datarails

Direct Or Indirect Cash Flow Which Is The Right Fit For Your Business Quickbooks

Direct Vs Indirect Cash Flow Do You Know The Difference

Constructing A Direct Cash Flow Forecast

Cash Flow Statement Cfs Definition Calculation Example

Cash Flow From Operating Activities Direct And Indirect Method Efm

Appendix Using The Direct Method To Prepare The Statement Of Cash Flows